IG Markets Review: A Professional yet Beginner-Friendly Powerhouse

IG Markets is one of the world’s leading online brokers, renowned for serving both seasoned professionals and serious beginners with equal finesse. With over 45 years in the industry (established in 1974) and a listing on the London Stock Exchange, IG offers a blend of deep experience and cutting-edge offerings.

In this review, we’ll explore what makes IG stand out – from its huge range of markets and robust platforms to its top-tier regulation, execution quality, and educational resources – across its key regions (UK, EU including Germany, Switzerland, and Australia).

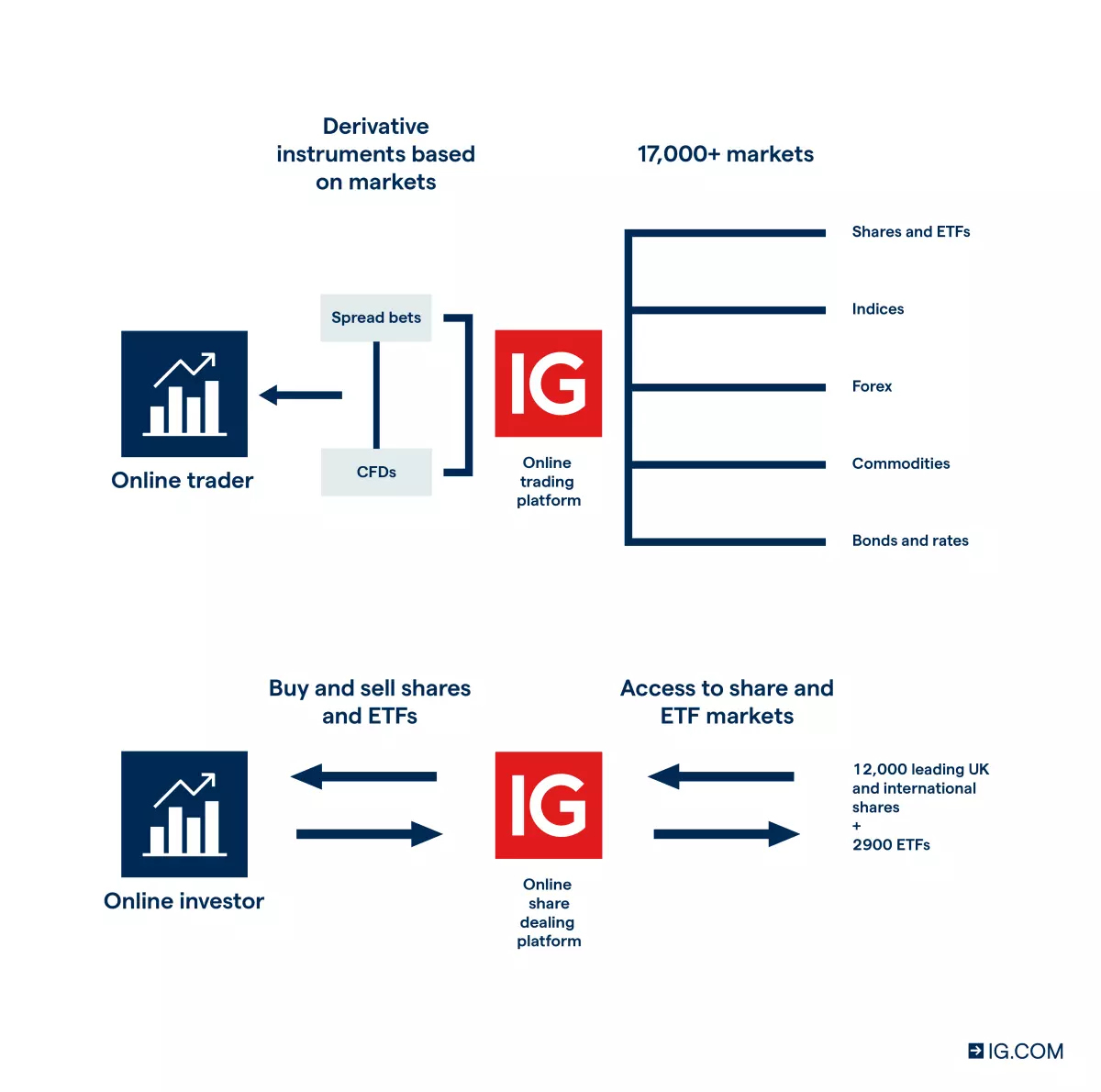

Vast Range of Markets & Unique Products

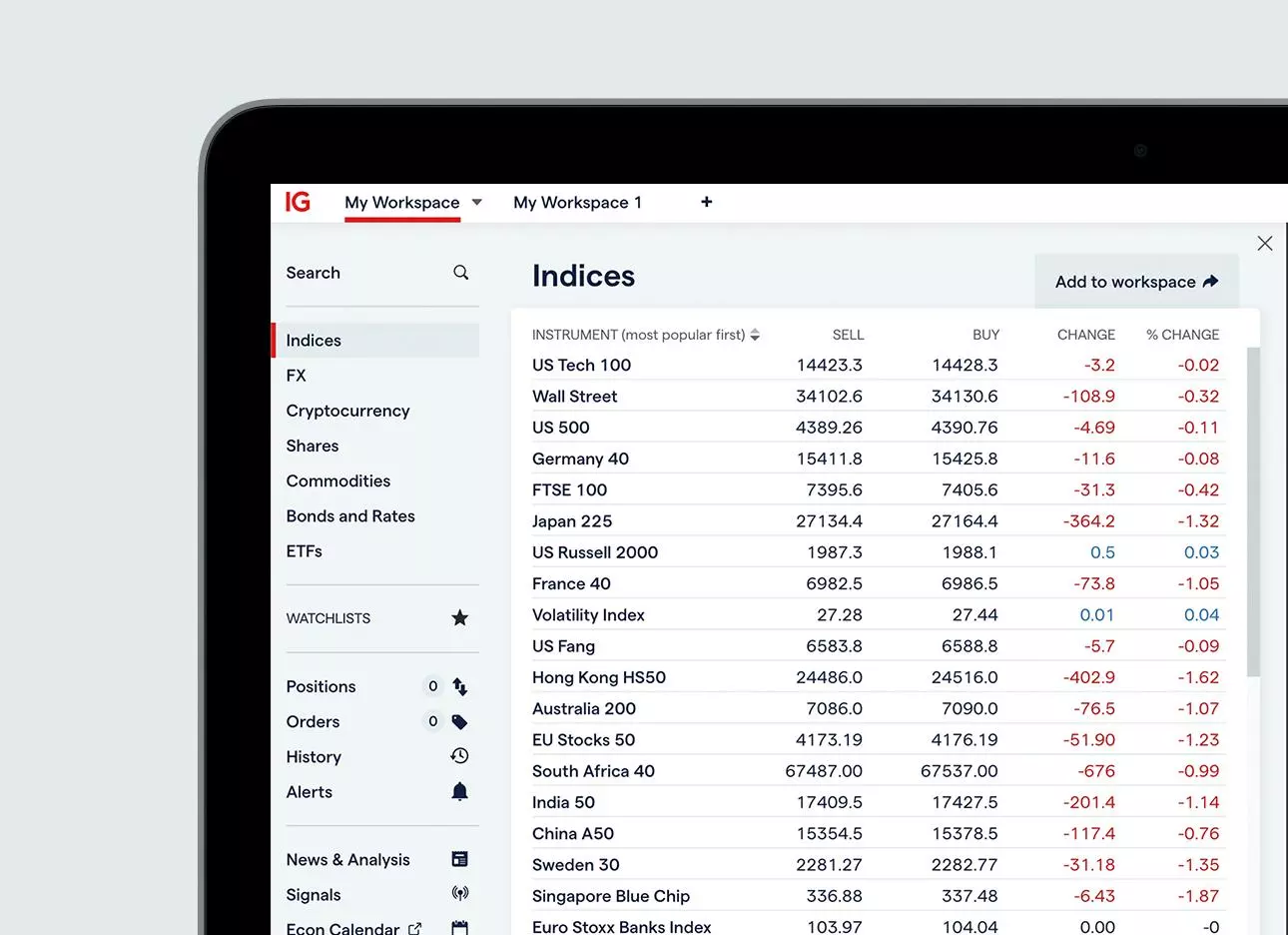

IG truly shines in the variety of markets and products available to its clients. Traders can access over 17,000 financial markets globally through IG – encompassing everything from forex and indices to commodities, stocks, and more. Here’s a breakdown of IG’s offerings and how they differ by region:

United Kingdom (UK) – Spread betting (exclusive to UK clients) and CFD trading are core offerings, covering thousands of markets. UK clients can also invest in real shares and ETFs via IG’s share dealing service, with £0 commission on US stocks under certain conditions.

Uniquely, IG UK even offers direct access to US exchange-listed options and futures through a dedicated platform, thanks to IG’s recent expansions. This means a UK trader can trade the S&P 500 via a CFD or trade options on S&P 500 futures – all under the IG umbrella.

European Union (EU) – e.g. Germany – IG’s EU clients trade primarily via CFDs and also have access to innovative instruments like “Turbo24” knock-out warrants. Turbo24s are IG’s 24-hour listed turbo certificates that let traders take leveraged positions with a built-in floor (knock-out level) – a limited-risk product unique to IG in Europe. IG Europe (based in Frankfurt) provides access to over 17,000 markets via these instruments, matching the breadth offered elsewhere.

Switzerland – Through IG Bank S.A. (IG’s Swiss arm), clients get a similar suite as EU customers. This includes CFD trading on tens of thousands of markets and access to Turbo24 certificates Swiss clients benefit from IG Bank’s status as a regulated bank under FINMA, meaning a high standard of security (more on that later). All major markets (global equities, FX, commodities, indices, etc.) are available to Swiss traders via CFDs or turbos, along with features like guaranteed-stop orders and extensive analytical tools.

Australia – IG holds a strong position in Australia, offering CFD trading across shares, forex, indices, commodities and more, as well as a robust share trading service for investing in stocks and ETFs. Australian clients can trade domestic shares (ASX) and international shares via IG’s share trading account, with competitive fees – for example, commission-free trading on US shares is available (with IG covering costs through slight FX conversion spreads). This makes IG AU not just a CFD broker but also a one-stop platform for trading and investing. Of course, standard CFDs are available on over 17,000 markets here as well, with forex spreads as low as ~0.6 pips on major pairs and key index CFDs like the Australia 200 with tight spreads during market hours (IG consistently ranks #1 in Australia for CFD trading by independent surveys).

Across all these regions, IG’s range of instruments is remarkably broad. You can trade global indices, thousands of shares, over 80 currency pairs, commodities from gold to oil, bonds and interest rates, and even cryptocurrencies (as CFDs or Turbo24 in jurisdictions where allowed).

For instance, IG offers major indices like the DAX with spreads from just 0.9 points during main hours, EUR/USD forex as low as 0.6 points, and spot gold from 0.3 – very competitive pricing. They even provide weekend trading on key indices and cryptocurrencies, allowing you to react to news even when traditional markets are closed. The sheer variety means both short-term traders and long-term investors will find suitable markets on IG.

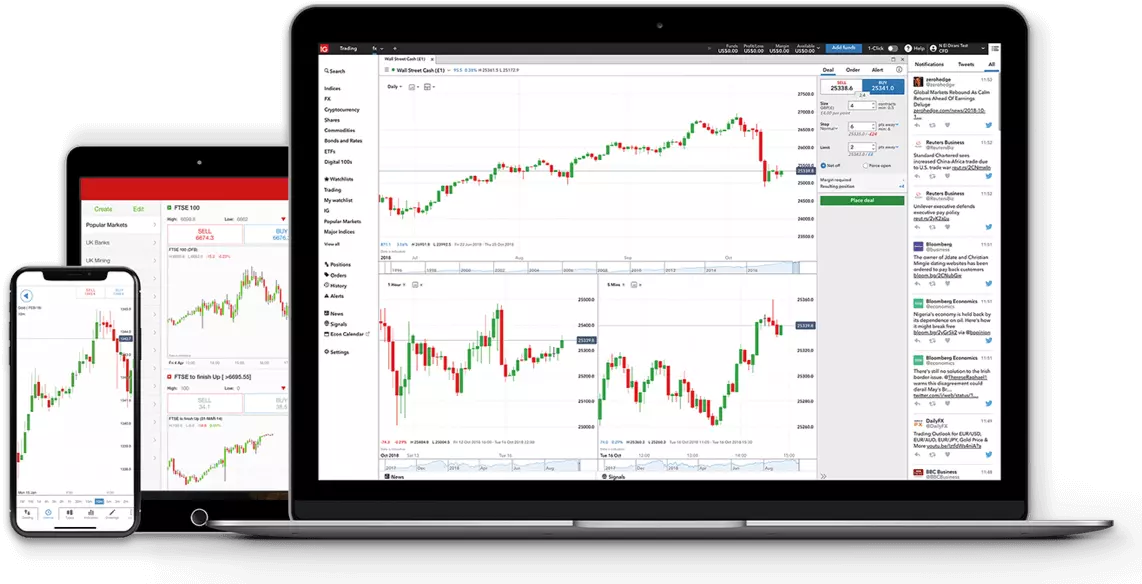

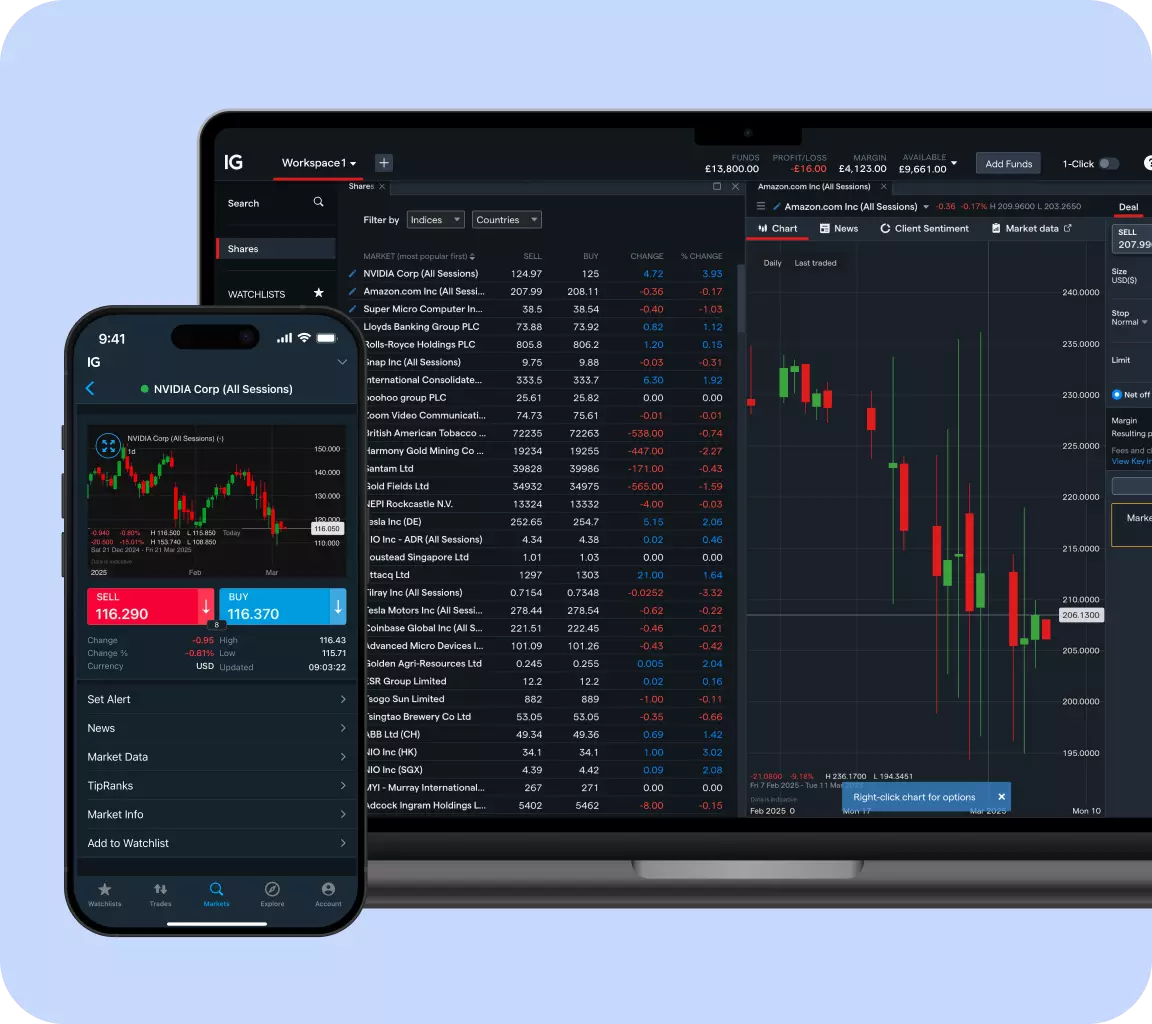

Platform Quality and Advanced Tools

IG has a reputation for excellent trading platforms – delivering a blend of professional-grade features with user-friendly design. Whether you’re a beginner or veteran, you’ll appreciate the flexibility and power of IG’s trading tools. The main platforms and features include:

- IG Proprietary Web Platform: IG’s award-winning web trading platform is the centerpiece. It’s easy to use yet packed with features. The interface is clean and customizable, with advanced charting (drawing tools, multiple timeframes, technical indicators) and the ability to trade directly from charts. You get an integrated Reuters news feed providing live market news inside the platform, as well as IG TV – IG’s own broadcast channel where market analysts discuss trends and trade ideas throughout the day. This means you can watch live market commentary (or recorded segments) and see breaking news without leaving your trading screen. There’s also an economic calendar and in-platform signals/scanner. For example, IG offers free trading signals on major markets (technical analysis-based trade ideas) and allows setting up three types of price alerts (when an asset moves by a certain amount, hits a level, or meets a technical condition). All these research tools – streaming news, analysis articles from IG’s experts, and price alerts – are built right in. Despite the rich feature set, the platform remains responsive and intuitive, making it suitable for newcomers who can start simple, and then use more advanced features as they grow.

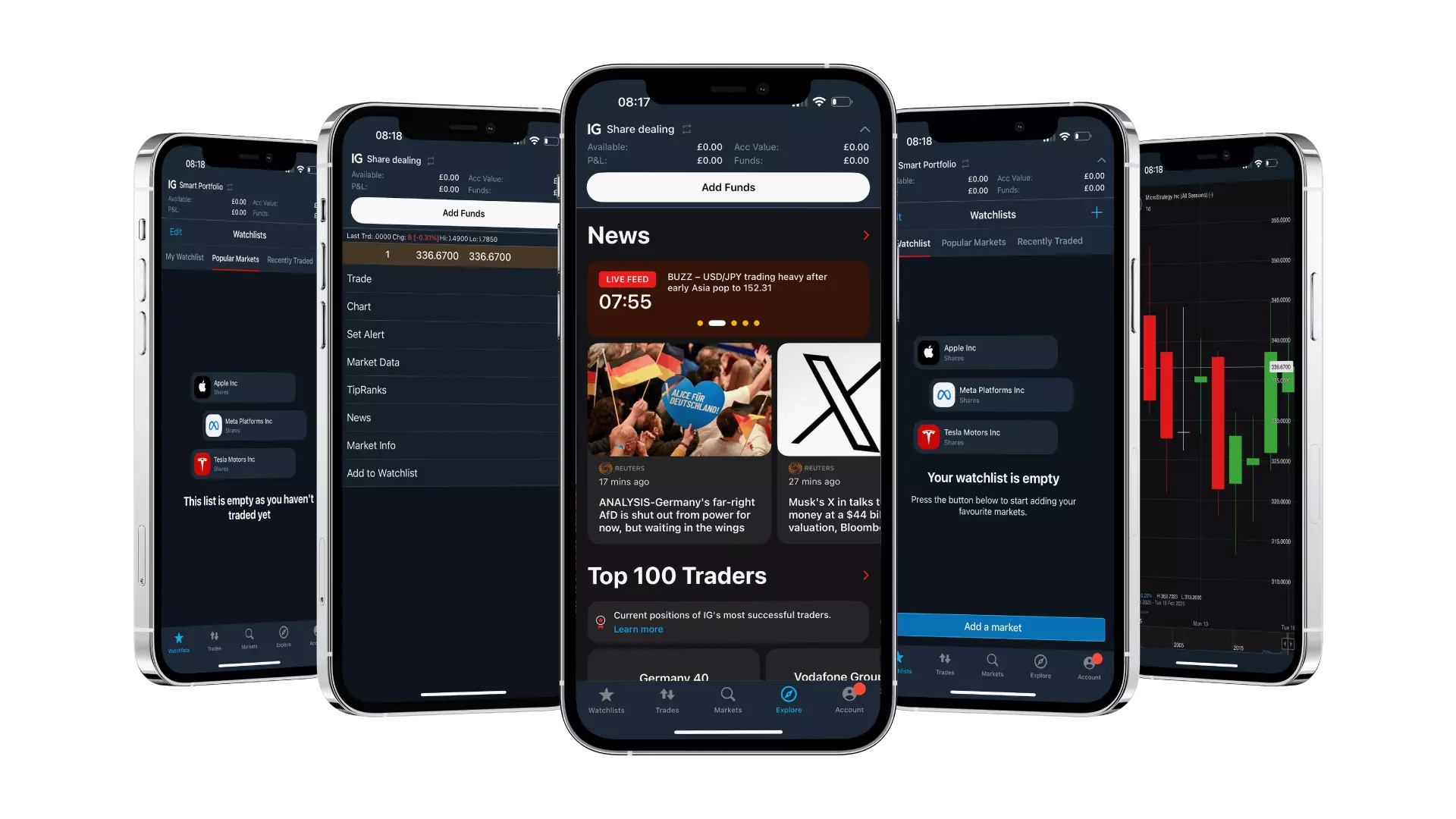

- Mobile Trading App: IG’s mobile apps (available on iOS and Android) mirror much of the functionality of the web platform. They are well-designed for on-the-go trading, letting you monitor positions, analyze charts, and execute trades from your phone or tablet. Impressively, you still have access to news, research, and even IGTV on mobile. The mobile app has won awards like Best Finance App 2024, reflecting its reliability and ease of use. Features like Face/Touch ID login, custom watchlists, and one-swipe trade execution make managing your trades convenient and secure from anywhere.

- MetaTrader 4 (MT4): For those who prefer third-party platforms or wish to use automated strategies (Expert Advisors), IG offers MetaTrader 4 integration. MT4 users can trade their IG account through the familiar MT4 interface, accessing forex, indices and commodity CFDs with IG’s pricing. IG even provides 18 custom add-ons and indicators for MT4, enhancing the standard platform. This is great for algorithmic traders or anyone who has existing tools built for MT4. Notably, unlike some brokers that restrict MT4 features, IG supports things like scalping and EAs on MT4 and has stable trade execution through this platform.

- ProRealTime (PRT): IG caters to advanced technical traders with ProRealTime, a powerful charting and trading platform. PRT offers incredibly detailed charts, automated strategy development (you can code your own trading systems in ProRealTime), and advanced analytics. IG provides ProRealTime free of charge for active clients (if you make at least 4 trades a month), which is a nice perk since PRT can otherwise carry a subscription fee. This platform is ideal if you need more sophisticated charting than the standard IG web platform – for example, if you want to do backtesting or use custom indicators. Launching PRT through IG lets you trade directly from its charts with your IG account.

- TradingView Integration: In a nod to modern traders’ habits, IG has integrated with TradingView as well. TradingView’s web-based charts and social network of traders are very popular. IG clients (in certain regions, like Europe) can connect their account to TradingView, allowing them to execute trades on IG directly from TradingView’s charts. This is a big plus for fans of TradingView’s interface and community – you get the best of both worlds: IG’s trade execution and spreads, with TradingView’s sleek charting and crowd-sourced ideas.

- L2 Dealer (Direct Market Access): For serious traders interested in DMA, IG’s L2 Dealer platform provides direct market access to share trading and certain CFDs. This is a downloadable platform where you can view the order book (Level 2 market depth) for stocks and place trades that execute directly on the exchange (for shares) or through smart routing for CFDs. It’s especially useful if you trade large share sizes or want to work orders within the market spread. L2 Dealer also has advanced order types and is free to use; you just pay the relevant market/exchange fees when doing DMA trades. This kind of professional-grade access is something many brokers don’t offer to retail clients, giving IG an edge for advanced stock traders.

- APIs and Algorithmic Trading: If you have programming skills or want to run black-box algorithms, IG supports API trading. They offer REST and streaming APIs so you can connect your own trading software or algorithms to IG’s execution systems. This is part of IG’s focus on serving advanced users and institutions (they even have a division for institutional services). A retail trader with coding knowledge can create custom trading bots or connect third-party tools via IG’s API – a feature only a handful of brokers provide with robust support.

All these platforms are supported by a suite of tools: IG has a trade analytics tool (to review your trading history and performance), market screeners, and client sentiment indicators showing the percentage of IG clients long or short on popular markets. Between the slick in-house platforms and integrations with popular external ones, IG ensures every trader finds a setup they’re comfortable with. It’s no surprise IG won “Best Platform for the Active Trader” and “Best Multi-Platform Provider” in 2024 – the platforms truly cater to all levels.

Execution Quality: Spreads, Slippage and Order Execution

When it comes to trade execution, IG sets a high bar, often outclassing smaller brokers. They leverage their large size and technology to ensure trades are filled quickly, at the best available prices, with minimal gimmicks. Here are some key points on IG’s execution and pricing:

- Competitive Spreads: IG’s spreads on major markets are among the most competitive for a full-featured broker. As mentioned earlier, spreads can be as low as 0.6 pips on EUR/USD and 0.9 points on the DAX index during peak hours. For the UK’s FTSE 100 index, spreads typically start at 1 point. Unlike some “zero-commission” brokers that hide costs in wide spreads, IG keeps spreads tight and transparent. They publish typical and minimum spread information for all markets on their website, so you know what to expect. Even for less common markets or outside main sessions, IG’s pricing is usually very reasonable thanks to their deep liquidity sources.

- Deep Liquidity & Trade Size Handling: One advantage of IG being a large player is deep liquidity – they handle a huge volume of trades daily, which helps in filling large orders without much slippage. For instance, IG discloses that they can automatically fill very sizable orders (multi-million pound notional) on major FX pairs and indices thanks to this liquidity. This is crucial for professional traders or anyone trading higher stakes – you’re more likely to get your full order filled at your requested price with IG, whereas a smaller broker might partially fill or requote you for large trades. IG also offers “partial fills” and “points through current” settings – advanced order options that let you control execution. Partial fills ensure that if IG can’t fill your entire order at once, they will fill as much as possible rather than rejecting it outright. Points-through-current allows you to pre-define how far beyond your price you’re willing to accept a fill, to avoid the order being rejected in fast markets. These features can be a lifesaver when you really need to get a trade on, at a specific size or within a volatile moment.

- No Requotes – Price Improvement Policy: IG’s execution model prioritizes giving clients the price they ask for (or better). For limit orders and quote orders, IG uses a “symmetrical tolerance” system: if the market moves slightly in your favor after you send the order, IG will fill you at the better price, improving your price automatically; if it moves against you beyond a small margin, IG rejects the order rather than filling you at a worse level. In other words, you’ll never get negative slippage on a limit order – you either get your price (or better) or the order isn’t executed. This policy protects traders from the sneaky slippage some brokers apply. In fact, IG reported that in one quarter of 2024, over 273,000 client orders received price improvements, saving clients about £3.5 million in aggregate by getting better fills. That’s a strong testament to IG’s fair execution practice. Market orders, of course, will get filled at the best price available, and IG’s liquidity helps ensure that’s usually the quoted price. Overall, you won’t experience the dreaded “requote” with IG – if a price isn’t available, they’ll just tell you to try again or deal at the current price, rather than slipping you unexpectedly.

- Guaranteed Stop-Loss Orders: Volatile markets can produce gaps and slippage, especially around major news. IG offers an excellent risk management tool: Guaranteed Stop orders. A guaranteed stop, if placed on a position, ensures your trade will be closed at exactly the price you set, with no slippage, even if the market gapped beyond your stop level. This is effectively an insurance policy against extreme moves. Importantly, IG does not charge upfront for guaranteed stops – you only pay a small fee if the stop is actually triggered (and thereby saved you from a worse loss). This fee depends on the market (often a few points added to the spread or a tiny percentage). Many brokers charge for simply placing a guaranteed stop; IG’s “pay only if used” approach is much more trader-friendly. Using guaranteed stops, you can trade indices or FX around events like elections with peace of mind that you won’t lose more than expected. IG even allows relatively tight guaranteed stop distances on most major markets (sometimes just a fraction of a percent away), so you can use them flexibly. This kind of protection, along with standard stop-loss and limit orders, helps level the playing field for retail traders – you won’t get the slip-and-hit that can happen elsewhere during, say, a flash crash, because IG eats that slippage on your behalf when you’ve bought the guarantee.

- Execution vs Small Brokers: In practice, many traders report that executing with IG feels reliable. Compared to smaller or less regulated brokers, IG’s platforms handle high volatility without frequent outages, and orders tend to fill at the quoted prices. Slippage can never be eliminated entirely, but IG’s scale and internal risk management mean it’s minimal and often positive (in your favor) when it occurs. By contrast, a small broker might widen spreads dramatically or slip orders when markets get fast; IG, with its best execution commitment, aims to keep spreads stable and fill orders as fairly as possible. Additionally, IG doesn’t engage in malpractices like asymmetrical slippage (where you only get slipped negatively). IG Group is publicly traded and under strict oversight, so it adheres to transparent execution standards. They even publish an annual Best Execution report detailing how they’ve met execution quality metrics.

In summary, whether you’re trading a £2 per point CFD or executing a £2 million position, IG’s infrastructure works to give you a smooth fill. The combination of tight spreads, large liquidity pools, price improvement technology, and optional guaranteed stops makes IG’s trading costs and execution outcomes very competitive. You can focus on your trading strategy without worrying about whether your broker will “be on the other side” of your trade in a bad way – IG’s interests are aligned with yours, backed by its long-standing reputation.

Regulation, Security of Funds & Trustworthiness

Safety and trust are crucial in choosing a broker, and IG excels here. It is one of the most heavily regulated brokers worldwide, with a stellar financial track record. Here are the highlights:

- Multi-Jurisdiction Regulation: IG is regulated in numerous top-tier jurisdictions. In the UK, IG Markets Ltd and IG Index Ltd are authorized by the Financial Conduct Authority (FCA). Across Europe, IG’s operations are run by IG Europe GmbH, based in Germany and regulated by BaFin (Germany’s Federal Financial Supervisory Authority) as well as the Bundesbank. In Switzerland, IG Bank S.A. is authorized by FINMA (the Swiss financial regulator) as a bank. In Australia, IG Australia Pty Ltd is licensed by ASIC (Australian Securities & Investments Commission) under AFSL No. 515106, and it’s also registered in New Zealand. Beyond these, IG has entities or licenses in Singapore, South Africa, Japan, Dubai, and more – in total eight Tier-1 jurisdictions by one industry count. This global oversight means IG must meet high standards for capitalization, risk management, auditing, and client protection everywhere it operates.

- Client Funds Segregation: No matter the region, IG follows strict rules to protect client money. All retail client funds deposited with IG are kept in segregated bank accounts at trusted banks, separate from IG’s own funds. This segregation is a regulatory requirement and ensures that, even if IG were to encounter financial trouble, your money is not mixed into their business assets. For example, IG states it holds client cash across a range of large banks (e.g., HSBC, in the UK) and even splits the funds across several banks to diversify risk. They do not use client money for hedging or operational purposes. In short, your trading account funds remain your funds. If IG (hypothetically) went into liquidation, segregated client money would be returned to clients minus any administrative costs, and any shortfall up to certain limits would be covered by compensation schemes in each jurisdiction.

- Investor Compensation Schemes: By virtue of its licenses, IG’s clients are often covered by government-backed compensation schemes. For instance, UK clients have FSCS protection up to £85,000 on their funds if IG were ever insolvent. In Europe, German regulations provide coverage (typically up to €20,000 under the EdW scheme for investment firms). Swiss accounts, since IG Bank is a bank, benefit from Swiss depositor protection (up to CHF 100,000 is commonly protected for Swiss bank clients). Australian clients are not under a formal government insurance scheme, but ASIC’s regulations ensure strict handling of client money (and Australia has a well-capitalized broker industry with additional protections via trust accounts). The bottom line: IG’s financial safeguards and external protections give a safety net rarely needed, but good to have. It’s very unlikely you’d face a loss of funds due to broker failure – IG Group is profitable, well-capitalized, and has been around for decades without major incident.

- Publicly Traded & Long Track Record: IG Group Holdings plc is listed on the London Stock Exchange (LON: IGG) and is part of the FTSE 250 index. This transparency adds trust – IG publishes financial reports, is scrutinized by analysts, and must adhere to high governance standards. As an example of its stature, IG’s market capitalization was around £3–4 billion in recent years. The company was founded in 1974 and has been a pioneer (it literally invented financial spread betting). Few brokers can claim 50 years of history. This longevity and success (hundreds of thousands of clients worldwide) suggest IG isn’t going anywhere and cares about its reputation. In reviews, IG consistently ranks at or near the top for trustworthiness. One industry review even noted IG holds the highest trust score among brokers, given its regulatory status and strong record.

- Platform Security and Support: On a day-to-day level, IG’s platforms have strong security (128-bit to 256-bit SSL encryption on web, and app security features) to protect your data. They also offer two-factor authentication for account login, adding an extra layer of protection. Customer support from IG is available 24 hours on trading days (24/5), so if you ever have an issue or a question about security, help is on hand. Additionally, because IG operates under strict regulations, they perform thorough KYC (Know Your Customer) and verification checks when you open an account – it might feel like paperwork, but it’s for the safety of your account and to prevent fraud. Overall, IG’s size and oversight mean you can trust them more than the average broker with your funds and data.

Account Opening and Service for Beginners

Opening an account with IG is a smooth online process. For most regions, you simply fill out a form on their website, provide some ID documents, and you can be up and running very quickly – often within minutes or a few hours for basic accounts. IG may verify your identity electronically. In some cases, you’ll need to upload a copy of your passport/ID and a proof of address (a standard step with any regulated broker) – IG provides an easy upload portal for this, and they approve documents within a couple of days at most. Many users report that account approval at IG is faster than at other brokers, likely because IG has efficient compliance teams in each region.

KYC (Know Your Customer): As a regulated entity, IG will ask about your trading experience and income when you sign up – this is to ensure, for example, that CFD trading is appropriate for you (an EU/UK requirement). It’s not an “exam,” but answer honestly. IG doesn’t generally reject clients who are beginners; at most they might guide you to learn more if you have no experience. Even serious beginners can start with IG – you just might get a slightly lower initial leverage until you understand the products, which is for your own protection. The process is straightforward and fully online, with no need to mail forms around. If any step is confusing, IG’s customer service is available to help walk you through it (they have phone and email support dedicated to account onboarding).

Once your account is open, funding it is easy: IG supports bank transfers, debit/credit cards, and in some regions e-wallets. Notably, in the UK and Europe, there’s no account minimum for bank transfers (you can fund as little as you want to start trading), though card deposits might have a small minimum like £250. In Australia, the minimum for CFD accounts is similarly around A$450. IG does not charge deposit fees (except some card payments might incur the card provider’s fee), and withdrawals are generally free too. Many users praise the speed of withdrawals – IG processes withdrawals typically within one working day, so you often get your money back within 1-3 days to your bank.

For those not ready to jump in with real money, IG offers a free demo account. The demo lets you practice on the full IG trading platform with live prices, using virtual funds. It’s a great way for beginners to get used to the interface and for experienced traders to test strategies under real market conditions. You can switch to live trading whenever you feel confident.

Education & Research: Helping You Improve

IG doesn’t just provide trading platforms; it actively helps clients learn and stay informed. This is a big benefit for newer traders and even experienced ones looking for insight. Some of the key educational and research offerings:

- IG Academy: This is IG’s comprehensive educational portal, filled with free online courses for traders at all levels. It literally ranges “from the most beginner concepts right up to advanced, professional trader level,” and it’s all free to use. Through IG Academy, you can take interactive courses on topics like introduction to financial markets, technical analysis, risk management, and even more complex strategies. These courses include quizzes to test your knowledge, and you can learn at your own pace. For example, a serious beginner might start with modules on how CFDs and leverage work, ensuring they understand the risks before trading. This commitment to education underlines IG’s approach: an informed client is a better (and likely longer-term) client.

- Webinars and Seminars: IG regularly hosts live webinars featuring market analysts and trading experts. Topics might include weekly market outlooks, how to trade around central bank meetings, or tutorials on using the platform’s advanced features. In some regions, IG has also held in-person seminars (pre-2020 these were more common; nowadays webinars are the main format). These interactive sessions allow you to ask questions. IG’s analysts often provide trading ideas and market updates in these webinars, which can spark ideas for your own trading.

- Daily Analysis – IG Research Team: IG has a team of market analysts who produce written news articles, analysis pieces, and trading ideas published on the IG platform and website. You’ll see an analysis feed (often under sections like "News and Trade Ideas") covering major market moves. For instance, if Apple’s earnings are coming up, IG’s analysts might publish an article on what to watch, complete with charts. There’s also the IG Morning Call (a live video update each morning on IGTV or YouTube) giving a rundown of overnight news and the day ahead for European markets, and an End-of-Day Wrap. All this content is freely accessible to IG clients (and much of it even to the public on IG’s site). It’s like having a financial news channel and research desk alongside your trading platform.

- Community and Forums: IG runs an online community forum where clients can discuss trading topics, ask questions, and even share strategies. IG staff participate at times, and you’ll find that many experienced IG users offer tips to newcomers in these forums. It’s a resource for peer learning – whether it’s a technical question about a platform feature or a debate about market outlook, the community adds another layer of support.

- Tools for Decision Support: We’ve touched on some, but to reiterate: IG provides numerous tools that help in decision-making, such as a stock screener (to filter stocks by fundamental criteria), client sentiment indicators (seeing the percentage of IG traders long or short on a given market in real time), and an economic calendar (with the option to set alerts for events). They also integrate third-party analysis tools like Autochartist (pattern recognition software) for free to clients in certain regions. If you want to get into the weeds, IG even offers premium features (for a fee) like level 2 data feeds for share trading, but these are optional and mainly for very active traders.

For a beginner starting out or a retail trader honing their skills, IG feels like not just a broker but a trading partner that provides the resources to grow. It’s no wonder that IG is often awarded for its education – one review called its education “industry-leading”. The mix of on-demand courses (IG Academy) and timely analysis (IG TV, news feeds) means you can continuously learn while actively trading.

Conclusion: A Broker That Balances Fun and Professionalism

IG Markets manages a rare feat: it caters to veteran traders demanding high performance, without alienating beginners who need guidance. Whether you’re a professional managing a large account or a serious novice taking your first steps, IG gives you the tools, markets, and support to thrive. You can speculate on just about anything with IG – from forex and CFDs to exclusive products like Turbo24s or exchange-traded options – using platforms that are as sophisticated or as straightforward as you need.

Moreover, you can trade with confidence that your broker is solidly regulated, financially strong, and technologically robust. Execution issues and doubts about fund safety tend to melt away when you’re with a broker that’s been a market leader for decades. Instead, you get to focus on the fun part of trading: analyzing markets and spotting opportunities, with a rich toolkit at your disposal.

In summation, IG isn’t the cheapest no-frills broker out there – it’s something better. It’s a comprehensive, premium service that still offers great value (low costs for the quality you receive). The slightly playful, accessible tone of IG’s educational materials and platform (you’ll notice they avoid jargon and even crack a joke or two in their platform tooltips) makes the experience enjoyable, while the under-the-hood power satisfies the most demanding traders. If you’re a retail trader with big ambitions or just someone who appreciates reliability and depth, IG Markets is undoubtedly one of the best in the business. Pros trust it – and so can you, even if you’re just starting out.

Sources: IG official websites for UK, EU (Germany), Switzerland, and Australia; IG Group and IG Academy materials; and independent reviews, among others. All information has been verified to reflect IG’s offerings and conditions as of 2025 in the aforementioned regions. Enjoy your trading journey with IG, and trade safe!